Equator Principles

The Equator Principles (EPs) are intended to serve as a common baseline and risk management framework for financial institutions to identify, assess and manage environmental and social risks when financing Projects.

The Equator Principles Association website:https://equator-principles.com

Join the Equator Principles Association

To facilitate the development of sustainable finance and guide businesses to pay attention to environmental protection and social responsibility. Agricultural Bank of Taiwan(ABT) has become a formal member of the Equator Principles Association on August 2023, and wholly complies with the 10 Principles of the Equator Principles from January 1, 2024.

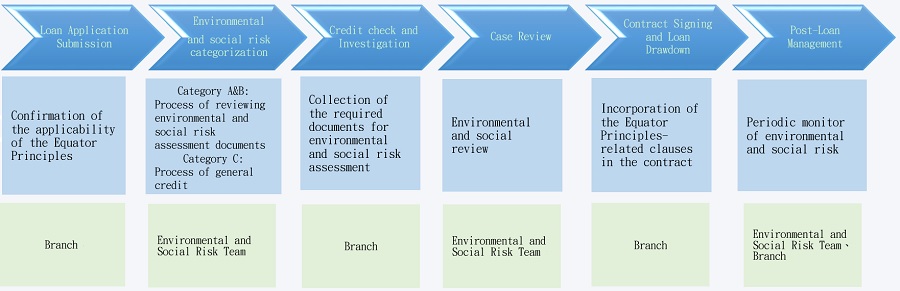

Impementation Procedure of the Equator Principles

To cooperate with the standards of the Equator Principles, ABT established ABT’s Guidelines for Equator Principles Compliant Loan Review according to the Equator Principles published by the Equator Principles Association, and sets up the Environmental and Social Risks Team, which is responsible for assessing the environmental and social risks of the Equator Principles credit applications ,and adjust the credit granting process to integrate the compliance mechanism to assure that the credit applications abide by the related requirements of Equator Principles and the environmental and social regulations to fulfill social responsibility of the bank.

Internal training

To ensure that each unit is well-equipped with the Equator Principles mechanism,ABT has commissioned an external consultant to conduct comprehensive training courses for the environmental and social risk team and all the business branches in 2023.This initiative highlights our commitment to professional development and our collective effort to deepen our colleagues' awareness of environmental and social risks.

Equator Principles Cases (Reporting period: 2024/1/1 – 2024/12/31)

Project Finance Advisory Service

| Number of cases | |

|---|---|

| Sector | |

| Mining | 0 |

| Infrastructure | 0 |

| Oil and Gas | 0 |

| Power | 0 |

| Others | 0 |

| Region | |

| Americas | 0 |

| Europe, Middle East and Africa | 0 |

| Asia Pacific | 0 |

| Total Number | |

| Total | 0 |

Note: Number of project finance advisory services during the reporting period

Project Finance

| Category | A | B | C |

|---|---|---|---|

| Sector | |||

| Mining | 0 | 0 | 0 |

| Infrastructure | 0 | 0 | 0 |

| Oil and Gas | 0 | 0 | 0 |

| Power | 0 | 1 | 0 |

| Others | 0 | 0 | 0 |

| Region | |||

| Americas | 0 | 0 | 0 |

| Europe, Middle East and Africa | 0 | 0 | 0 |

| Asia Pacific | 0 | 1 | 0 |

| Country Designation | |||

| Designated Country | 0 | 0 | 0 |

| Non-Designated Country | 0 | 1 | 0 |

| Both | 0 | 0 | 0 |

| Independent Review | |||

| Yes | 0 | 1 | 0 |

| No | 0 | 0 | 0 |

| Total Number | |||

| Total | 0 | 1 | 0 |

Note: Number of project finance that reached Financial Close during the reporting period

Project-Related Refinance or Project-Related Acquisition Finance

| Number of cases | |

|---|---|

| Sector | |

| Mining | 0 |

| Infrastructure | 0 |

| Oil and Gas | 0 |

| Power | 0 |

| Others | 0 |

| Region | |

| Americas | 0 |

| Europe, Middle East and Africa | 0 |

| Asia Pacific | 0 |

| Total Number | |

| Total | 0 |

Note: Number of project-related refinance or project-related acquisition finance that reached Financial Close during the reporting period.

Project-Related Corporate Loans

| Category | A | B | C |

|---|---|---|---|

| Sector | |||

| Mining | 0 | 0 | 0 |

| Infrastructure | 0 | 0 | 0 |

| Oil and Gas | 0 | 0 | 0 |

| Power | 0 | 0 | 0 |

| Others | 0 | 0 | 1 |

| Region | |||

| Americas | 0 | 0 | 0 |

| Europe, Middle East and Africa | 0 | 0 | 0 |

| Asia Pacific | 0 | 0 | 1 |

| Country Designation | |||

| Designated Country | 0 | 0 | 0 |

| Non-Designated Country | 0 | 0 | 1 |

| Both | 0 | 0 | 0 |

| Independent Review | |||

| Yes | 0 | 0 | 0 |

| No | 0 | 0 | 1 |

| Total Number | |||

| Total | 0 | 0 | 1 |

Note: Number of project-related corporate loans that reached Financial Close during the reporting period.